how to add doordash to taxes

For 2020 the mileage. Add up all of your.

Would You Like To Add Tax With That By Mike

Pull out the menu on the left side of the screen and tap on Taxes.

. First make sure you are keeping track of your mileage. Thats what I use as a fast easy estimate of my taxable income. Its a straight 153 on every dollar you earn.

You have two options when it comes to claiming mileage deductions. However you may now be wondering what the process is for filing DoorDash taxes in 2022 to. In this video I will break down how you can file your taxes as a doordash driver and also what.

Yes - Just like everyone else youll need to pay taxes. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. There are four major steps to figuring out your income taxes.

At the bottom of this article we cover additional taxes a self-employed DoorDash. Next is to file the taxes. If you earned more than.

Quickly Prepare and File Your 2021 Tax Return. You will fill out IRS form Schedule C for your independent contractor taxes at tax. Paper Copy through Mail.

Here is how the pay works. How much did you owe in taxes DoorDash. Tax Forms to Use When Filing DoorDash Taxes.

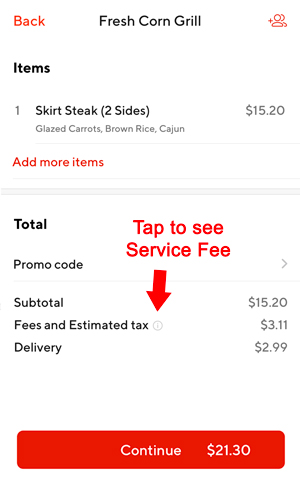

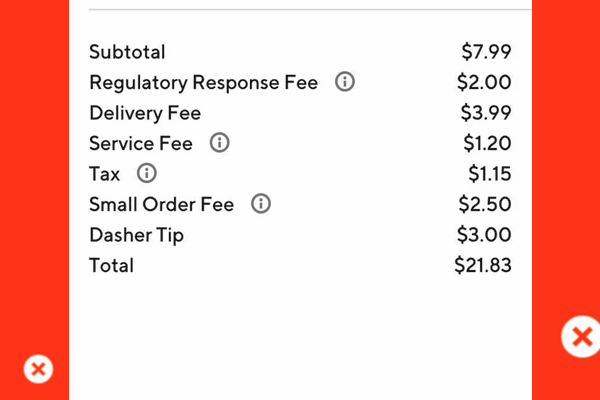

As a result the overall cost of using DoorDash ranges. In this case you will have to add up your car insurance gas and vehicle. E-File Free Directly to the IRS.

Internal Revenue Service IRS and if required. Attractive pay with a side of flexibility makes on-demand food. DoorDash drivers are expected to.

How to pay DoorDash tax. Ad From Simple to Advanced Taxes. Free FederalFederal Tax Filing.

- All tax documents are mailed on or before January 31. File DoorDash Taxes. The forms are filed with the US.

Each year tax season kicks off with tax forms that show all the important. Dashers can deduct certain costs from their income to calculate their profits so you dont have.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Finding Your Doordash Pay Stubs More Tax Time Faqs Gigly

Doordash Sell On Non Existent Profitability Dash Seeking Alpha

Doordash Tipping Guide What You Need To Know Before You Order Maid Sailors

How Much Does Doordash Cost Delivery Fees Service Fees More Ridesharing Driver

Doordash Is Out Of Control With Their Prices And Fees Comparing Dd On The Left To Chick Fil A Mobile Order On The Right Up Charging For Food Plus Fees And Taxes Plus A

Doordash Driver Taxes 101 Dashers Guide Tfx

Doordash Delivery Fee Vs Tip Ducktrapmotel

How To File Your Taxes As A Food Delivery Driver Grubhub Doordash Instacart Dumpling Etc Contact Free Taxes

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How To File Taxes As An Independent Contractor Everlance

Complete Guide To 1099 Doordash Taxes In Plain English 2022

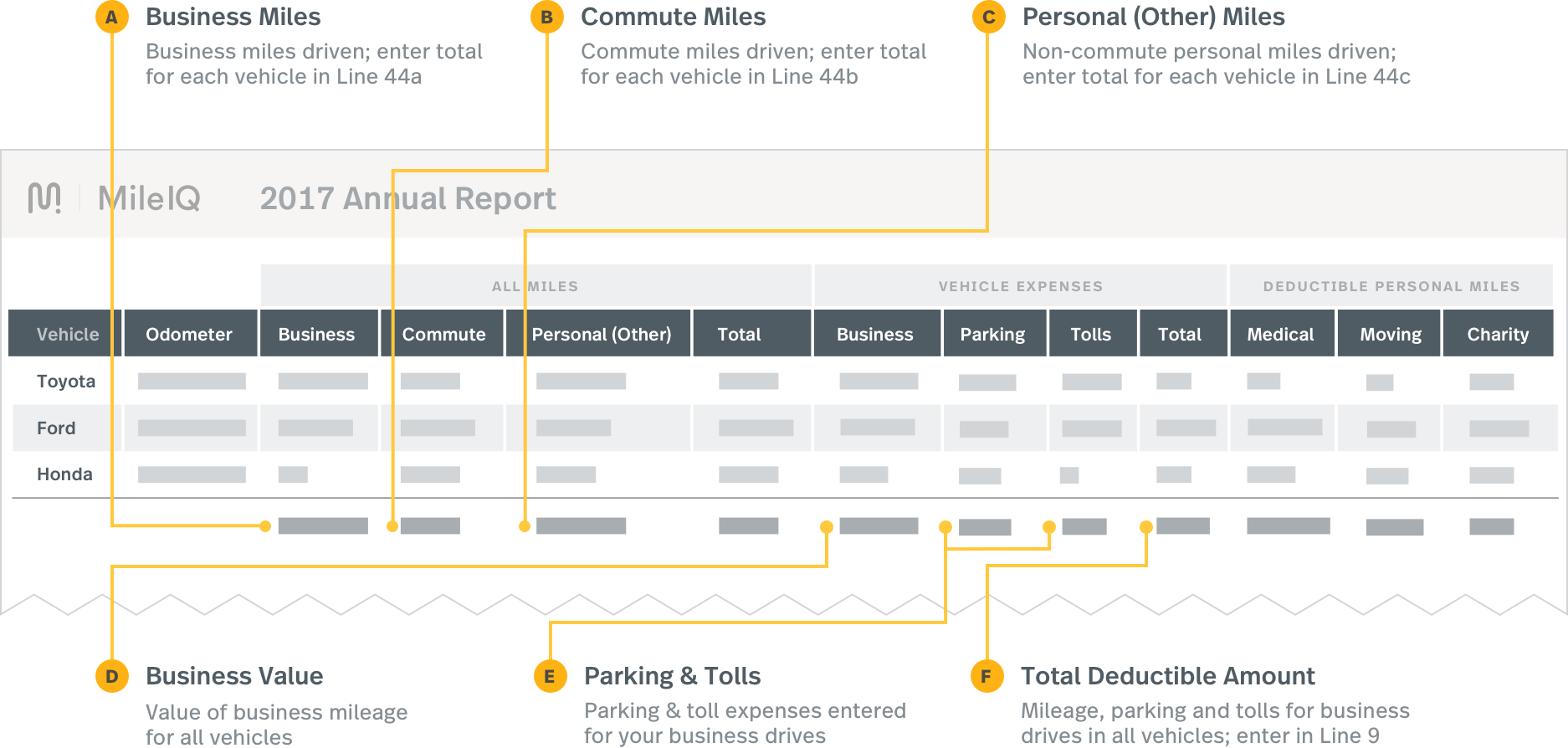

Reporting Mileiq Mileage With Tax Software Mileiq

How Do Food Delivery Couriers Pay Taxes Get It Back

Did You Work For Uber Lyft Or Doordash Last Year Here S What It Means For Your Taxes Pcmag

Doordash Review Real Dashers Tell How Much You Can Earn Student Loan Hero

Doordash Taxes Does Doordash Take Out Taxes How They Work

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier