nebraska sales tax calculator

2022 Nebraska state sales tax. The Nebraska state sales and use tax rate is 55 055.

States With The Highest And Lowest Sales Taxes

Its important to note that some items are exempt from sales tax in Nebraska including prepared food and related ingredients.

. This includes the rates on the state county city and special levels. For example lets say that you want to purchase a new car for 60000 you would use the. Sales Tax Table For Nebraska.

Sales Tax Chart For Lancaster County Nebraska. This includes the rates on the state county city and special levels. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

Use e-Signature Secure Your Files. For a more detailed breakdown of rates please refer to our table below. Or Choose Cost Includes Sales Tax which means the figure you entered at step 2 is the gross amount for the goods service and the calculate will calculate and deduct the relevant Sales.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. The most populous location in Hitchcock County Nebraska is Culbertson.

Find your Nebraska combined state. The latest sales tax rates for cities in Nebraska NE state. This includes the rates on the state county city and special levels.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 645 in Lancaster County. Make a Payment Only. Ad Access Tax Forms.

The Nebraska NE state sales tax rate is currently 55. Average Local State Sales Tax. Ad Download Avalara sales tax rate tables by state or search tax rates by individual address.

The base state sales tax rate in Nebraska is 55. For a more detailed breakdown of rates please refer to our. Nebraska sales tax details.

Sales and Use Tax. The Nebraska state sales and use tax rate is 55 055. Maximum Local Sales Tax.

A full list of these can be found below. The sales tax rate in Fairbury Nebraska is 75. Request a Business Tax Payment Plan.

Sales Tax Rate Finder. Nebraska Capital Gains Tax. Complete Edit or Print Tax Forms Instantly.

Try it for Free Now. The sales tax rate in Beatrice Nebraska is 8. Long- and short-term capital gains are included as regular income on your Nebraska income tax return.

Rates include state county and city taxes. Choose Avalara sales tax rate tables by state or look up individual rates by address. Choose Avalara sales tax rate tables by state or look up individual rates by address.

The average cumulative sales tax rate in Lincoln Nebraska is 719 with a range that spans from 55 to 725. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 605 in Nebraska. All numbers are rounded in the.

Nebraska State Sales Tax. Maximum Possible Sales Tax. The average cumulative sales tax rate between all of them is 55.

Exact tax amount may vary for different items. So no matter if you live and run your business in Nebraska or live outside Nebraska but have nexus there you would charge sales tax at the rate of your buyers ship-to location. Upload Modify or Create Forms.

2020 rates included for use while preparing your income tax deduction. Ad Download Avalara sales tax rate tables by state or search tax rates by individual address. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75.

You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

The calculator will show you the total sales tax amount as well as the county city. As of 2019 the Nebraska state sales tax rate is 55. That means they are taxed at the rates listed.

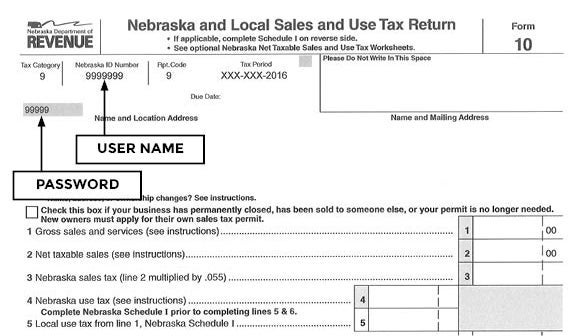

Online Sales And Use Tax Filing Faqs Nebraska Department Of Revenue

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Nebraska Sales Tax Rates By City County 2022

Nebraska Income Tax Calculator Smartasset

Form 10 Fillable Nebraska And Local Sales And Use Tax Return With Schedule I Mvl And Instructions 10 2011

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

State And Local Sales Tax Deduction Remains But Subject To A New Limit Marks Paneth

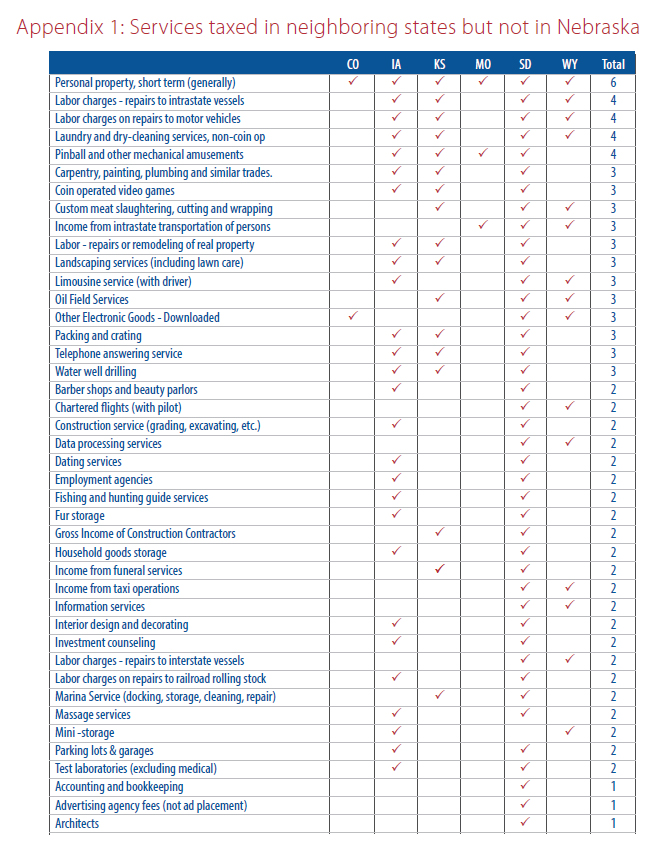

Taxes And Spending In Nebraska

Nebraska Sales And Use Tax Nebraska Department Of Revenue

State Income Taxes Highest Lowest Where They Aren T Collected

Nebraska Income Tax Ne State Tax Calculator Community Tax

Earn Up To 000 In Tax Credits Nebraska Microentrerprise Tax Credit

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Sales And Use Tax Nebraska Department Of Revenue

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified